Normally, all I have to cover is the $45 co-pay, and the rest is covered by my PPO health insurance. When I was billed $250 of the PPO portion, I immediately contacted the insurance company, they stated that it should have been a covered expense, yet they had nothing to do with it because the billing office at the medical provider’s end charged me, not the insurance company. However, instead of leaving it at that, my insurance company informed me that they would contact the billing office to work it out. They asked me to wait approximately two weeks for everything to be ironed out, also stating that they were almost 100% sure that it would be resolved in my favor, that it was what is known as a “coding error”. They said I could most likely count on all of the $250 eventually being paid by the insurance.

Instead of being a complaint, this post gives kudos to not only my insurance company, but also the people of that billing department of the medical provider. Approximately 36 hours after I hung up from speaking with my insurance company, the situation was resolved, and I only had to pay the $45 co-pay. The $250 disappeared completely from my billing responsibility. The entire issue, which started out to be stressful and worrisome for me, not only was resolved well under the two week forecast, but it was also resolved smoothly and to my complete satisfaction. I’ve already contacted both agencies and given them praise.

What’s a recent financial victory that you have had similar to the one that I list here?

~

Thanks! I’m glad that your son was not hurt in all of this, it’s the best part about the whole thing.

The theft of the catalytic converter at the end, however, absolutely floored me! Grrrrrrrrrrr. Thieves will take advantage of even the slightest opportunity, won’t they? What lowlifes. Did you then file a separate claim due to the theft?

Your saving grace in the entire story was your reading through the policy to verify exactly what coverage it offered (especially if you found it in the fine print), and holding the insurance company to its accountability for it. Great job standing your ground.

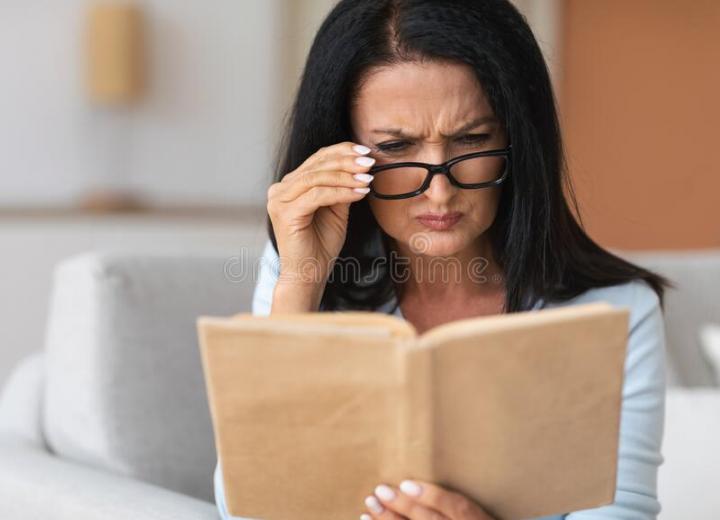

(P. S. I’m not intimating that the woman in the photo is supposed to represent what you look like, nor that I think that that’s how you look. It’s her actions that I mean to convey. Lol.)

~