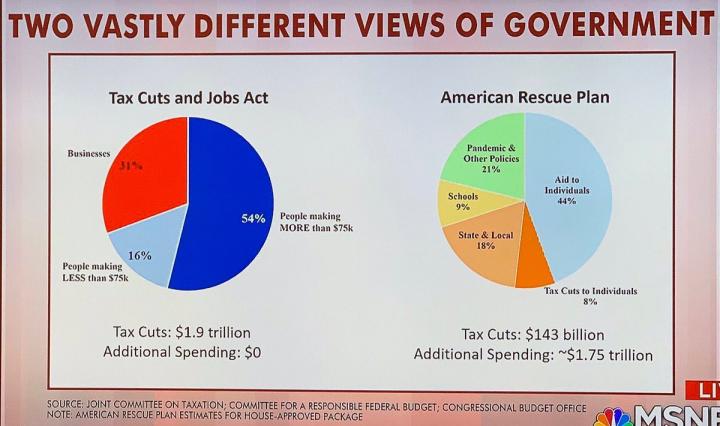

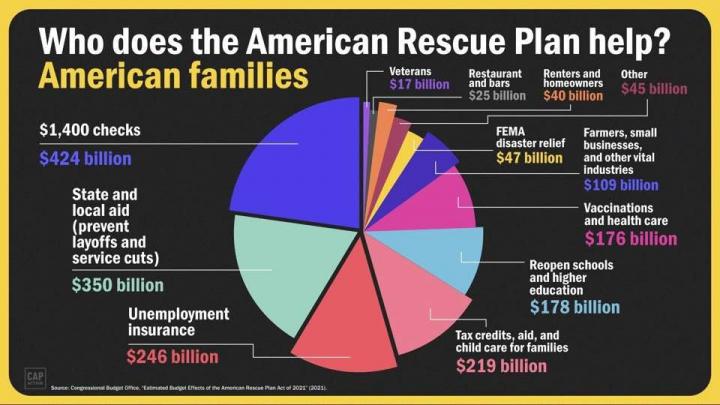

The $1.9 trillion dollar COVID 19 relief package going to the "little people".

Did he say diddly when that grotesque amount was gifted to the obscenely wealthy several years ago in the form of tax cuts? Hahahahahahahahahahahahahahahahahahahaha. Of course not.

Whattan arse a** jack he is.

This post was edited by SpunkySenior at March 19, 2021 6:03 AM MDT

This post was edited by SpunkySenior at March 19, 2021 6:03 AM MDT

There is over $100M in for a subway/rail project in CA and to build a bridge in NY. That is not COVID relief.

"All told, this generous definition of Covid-related provisions tallies some $825 billion. The rest of the bill—more than $1 trillion—is a combination of bailouts for Democratic constituencies, expansions of progressive programs, pork, and unrelated policy changes."

https://www.wsj.com/articles/the-non-covid-spending-blowout-11613937485

I know Trump tax cuts helped me. And I ain't no 1%er. And Yes I will be getting my $2800.